The narrative surrounding AI search in 2025 has been dramatic:

ChatGPT will replace Google, traditional search is dying, and marketers must abandon SEO for AI optimization.

Scroll through LinkedIn or read tech headlines, and you’d think Google was on life support while ChatGPT was prepared to dominate the search landscape.

The reality? It’s not even close. While ChatGPT represents an important evolution in how people seek information, the data tells a fundamentally different story than the hype suggests.

Google’s dominance in search remains overwhelming, and understanding why, and what it means for marketers matters far more than chasing sensational predictions about traditional search’s imminent demise.

Key Findings:

- Google processes 373x more searches than ChatGPT (14B vs. 37.5M daily), holding 93.57% market share.

- Google grew 20%+ in 2024; BrightEdge shows market share up from 90.54% to 90.71% in late 2025.

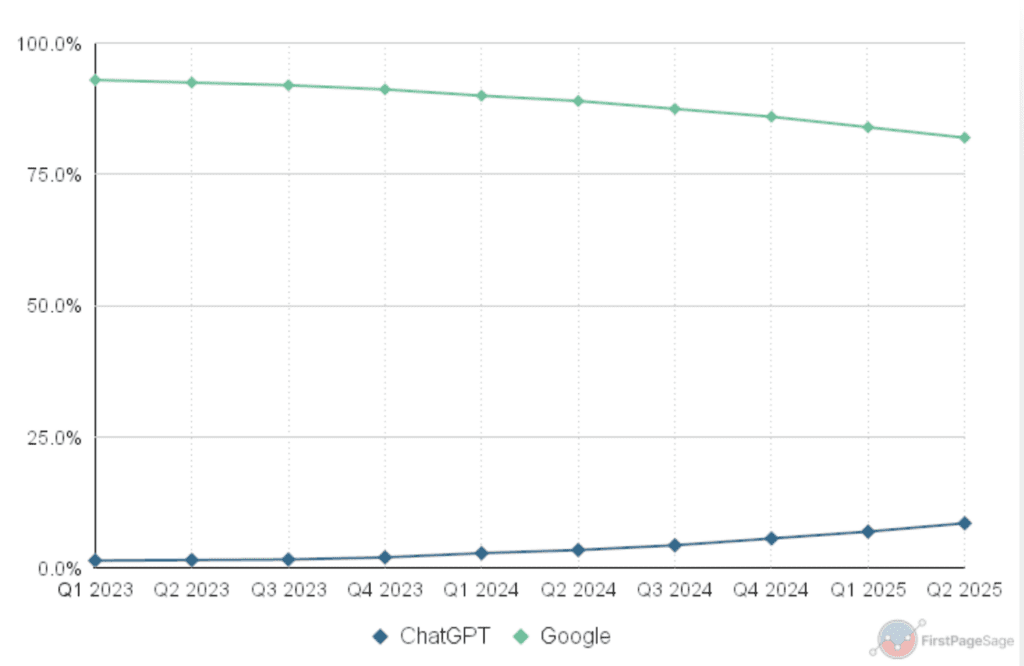

- First Page Sage Q2 2025: Google 81.6% of queries vs. ChatGPT’s 9.0%; Google dominates transactional, ChatGPT informational.

- “ChatGPT Paradox”: Users research on AI but buy via Google; 72% B2B buyers see AI Overviews, 90% click sources.

- Marketers: Prioritize Google SEO (90% resources) for commercial value; unified authority content boosts both.

The Data Speaks: Google’s Overwhelming Advantage

The Scale Gap Is Massive

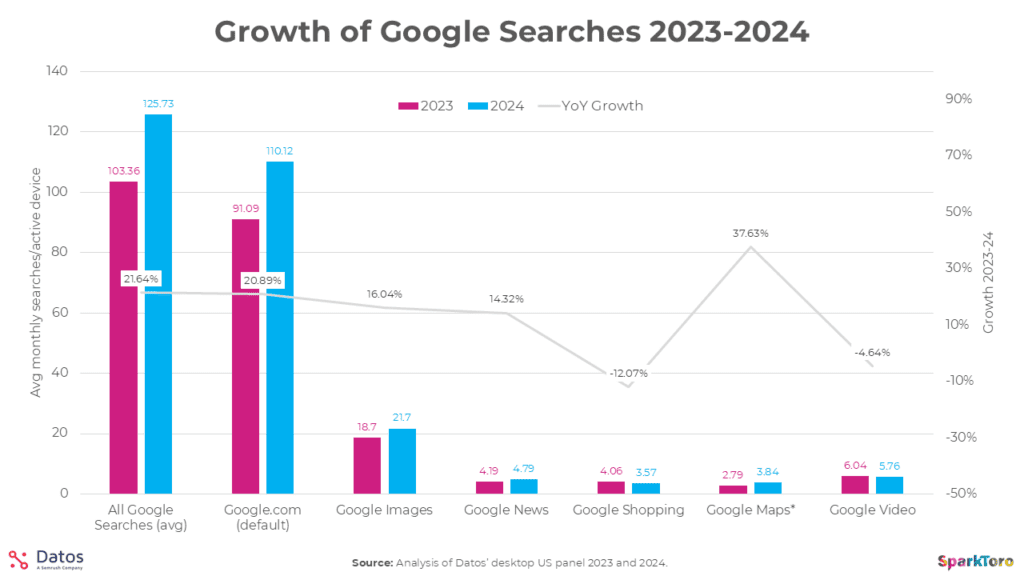

According to research by SparkToro’s Rand Fishkin, analyzing comprehensive data from Semrush, Google receives approximately 373 times more searches than ChatGPT. In concrete terms, Google processed over 5 trillion searches in 2024; roughly 14 billion per day, giving it a 93.57% market share..

To put this in perspective, ChatGPT’s search volume is on a scale similar to Pinterest’s daily searches. These are orders of magnitude apart.

Google Actually Grew in 2024

Perhaps even more surprising to those predicting Google’s decline: the search giant grew 20%+ in 2024, the year ChatGPT supposedly threatened its dominance. This growth occurred despite (or perhaps alongside) the rise of AI chatbots, suggesting that AI search and traditional search serve complementary rather than competing purposes for most users.

Recent data from BrightEdge, an SEO analytics firm working with a majority of Fortune 500 companies, shows Google’s market share increased from 90.54% to 90.71% in late 2025. While a 0.17% increase seems small, at Google’s scale, it represents approximately $340 million in ad revenue.

More significantly, this gain came directly from AI search platforms like ChatGPT, Perplexity, and Grok losing market share for the first time since tracking began.

The Intent Distribution Tells the Story

The First Page Sage market share report analyzing Q2 2025 data reveals that Google still commands over 80% of all digital queries globally, while ChatGPT accounts for 9.0% of queries. But this topline number obscures crucial differences in what people use each platform for.

Google balances research with buying behavior: about half its users seek information, while a meaningful portion are actively shopping, booking services, or engaging in commercial activities.

This is what marketers call the “ChatGPT Paradox”: people go to ChatGPT for answers, not products. They research there but buy on Google.

Audience Behavior and Why Google Still Wins

| Aspect | Google Search | ChatGPT Search |

| Query Type Dominance | Dominates transactional queries (buying, booking, commercial actions) | Strong in informational and research queries |

| User Trust | Trusted for local results, verified listings, real-time availability, and direct purchase paths | Trusted for detailed explanations; refers back to authoritative websites (often Google) |

| Device Usage | Mobile-first design; dominates casual/on-the-go searches | Stronger on desktops; preferred by professionals/researchers for deep research |

| Age Demographics | Increasing dominance with older, higher spending power demographics | Higher adoption among younger users, especially for academic/creative tasks |

| Competitor for Younger Users | Social platforms surpass Google and ChatGPT for Gen Z searches | Less used by Gen Z compared to social platforms for answers |

| Session Duration vs. Action | Shorter sessions but higher conversion/action (0.6 clicks per visit) | Longer session duration, more exploratory (1.4 external clicks per visit) |

| Commercial Value | High, as transactional queries yield revenue | Lower, exploratory research driving action elsewhere (usually Google) |

Why Does This Matter?

Resource Allocation Should Follow Reality

With Google processing 373 times more searches than ChatGPT and owning virtually all transactional queries, businesses risk catastrophic misallocation by shifting resources away from traditional SEO toward AI-only optimization strategies. Google remains where the overwhelming majority of commercial discovery and conversion happens.

This doesn’t mean that we should ignore ChatGPT. It means maintaining proportionate focus. Google’s 90%+ (as mentioned above) share represents the vast majority of search-driven business outcomes. ChatGPT’s 0.25% share, while growing, remains marginal by comparison.

The Complementary Model Wins

Rather than choosing between Google and ChatGPT, smart marketers optimize for both by understanding their complementary roles.

- ChatGPT excels at educating prospects, answering complex questions, and providing detailed explanations.

- Google drives appointment bookings, purchase decisions, and immediate commercial actions.

For B2B businesses, this means creating comprehensive, authoritative content that serves both platforms:

- Educational material that ChatGPT can cite when prospects research

- Combined with service pages optimized for Google when those same prospects are ready to buy.

Does AI Search Still Matter?

Growing But From a Tiny Base

ChatGPT is growing faster than Google, but from an infinitesimally small base. Growing 50% year-over-year sounds impressive until you realize you’re growing from 0.25% to 0.375% market share. At that rate, catching Google would take decades, assuming Google remains static, which it isn’t.

Google has responded to AI search competition by integrating AI Overviews directly into results.

According to TrustRadius research, 72% of B2B technology buyers now encounter Google’s AI Overviews during research, with 90% clicking through to source materials for verification.

This means Google is capturing AI-driven behavior within its own ecosystem rather than losing it to ChatGPT.

Specific Use Cases Justify Attention

While ChatGPT doesn’t threaten Google’s overall dominance, it does excel in specific contexts worth optimizing for. When prospects ask “What should I know about [complex topic]?” or “Compare [option A] versus [option B],” ChatGPT provides detailed explanations that Google’s snippet format can’t match.

For businesses selling complex products or services requiring education before purchase, having ChatGPT cite you during research phases adds value even if Google drives the eventual conversion. The research happens in ChatGPT; the decision gets executed through Google.

Future-Proofing Versus Present-Optimizing

Even if ChatGPT never approaches Google’s scale, understanding AI search mechanics future-proofs strategies. As Google integrates more AI into its own results and other platforms emerge, the principles of creating comprehensive, authoritative content that AI systems can confidently cite remain valuable.

But future-proofing doesn’t mean neglecting present reality. The vast majority of business outcomes today flow through Google.

Investing 90% of resources in Google optimization and 10% in broader AI visibility roughly matches their relative impact, not the 50-50 split some AI hype suggests.

The Warning Against Opportunism

BrightEdge’s Yu cautions that recent months have seen companies offering “AI SEO” services promising guaranteed ChatGPT placement or claiming insider methods for AI-generated results. These claims should trigger skepticism. No one controls how ChatGPT or other AI systems cite sources, just as no one guarantees #1 Google rankings.

The legitimate approach is the same across platforms: strong brand, excellent technical fundamentals, and genuinely valuable content. These elements rank well in traditional search and get cited by AI systems. Chasing shortcuts or separating AI optimization from traditional SEO yields mediocre outcomes in both.

This explains the reality of search today. Next is deciding how your brand earns visibility across Google and AI answers in 2026. Book a call with ReSO to align strategy with where decisions are actually made.